|

|

Blackgram (Urad) |

||||||||||||||||||||||||||||||||||||||||||

| 05 October 2015 06:12 PM | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

|

Black gram is a member of the Asiatic Vigna crop group. It is an annual pulse grown mostly as a fallow crop in rotation with rice. Similar to the other pulses, black gram, being a legume, enriches soil nitrogen content and has relatively short (90-120 days) duration of maturity.

Black gram is scientifically known as Phasiolus mungo and it is commonly known as Urad in India. India is its primary origin and is mainly cultivated in Asian countries including Pakistan, Myanmar and parts of southern Asia. About 70%t of world’s black gram production comes from India.

Economic Importance:

Urad is grown primarily for its protein rich seeds. Urad contains 20-25% protein. Urad daal is an important ingredient in most of the Indian snacks and fast food.

Seasons and cultivation

Black gram is a warm weather crop and comes up in areas receiving an annual rainfall ranging from 600 to 1000mm. It is mainly cultivated in a cereal-pulse cropping system primarily to conserve soil nutrients and utilize the left over soil moisture particularly, after rice cultivation. Hence, although it can be grown in all the seasons, majority of black gram cultivation falls in either rabi or late rabi seasons particularly in peninsular India.

Optimum temperature range for growth is 27-30oC. A dry harvest period is desirable as this forces the crop to mature and reduces the risk of weather damage. It comes up well on water retentive soils but cannot stand saline and alkaline conditions. Black gram is more tolerant of water logging than moong bean.

Domestic Scenario

India is the world’s largest producer as well as consumer of black gram. It produces about 1.5 to 1.9 million tons of urad annually from about 3.5 million hectares of area, with an average productivity of 500kg per hectare. Black gram output accounts for about 10% of India's total pulse production.

Urad production in the country remained stable more than a decade through the 2000s at around 12 to 14 lakh tons. But a sudden jump in output was noted in 2010-11 to 17.5 lakh tonnes primarily on account of rise in production from Madhya Pradesh, Rajasthan and Tamil Nadu.

Source: Ministry of Agriculture, GoI, IGPA and Trade Sources

State-wise Production

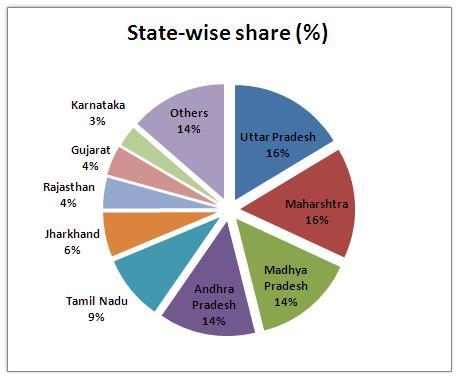

Urad production in the country is largely concentrated in five states viz, Uttar Pradesh (UP), Maharashtra, Madhya Pradesh, Andhra Pradesh and Tamil Nadu. These five states together contribute for about 70% of total Urad production in the country.

There is a distinct change in production pattern of Urad across states. Traditionally Uttar Pradesh, Maharashtra and Madhya Pradesh are major Urad producing states. But there is significant rise in production from other states in recent years particularly, from Tamil Nadu, Jharkhand and Rajasthan. Nevertheless, production remained volatile across the years with respect to most of the states.

As per the latest available estimates, UP and Maharashtra occupy the first two positions, contributing over 32%. Individually, Madhya Pradesh and Andhra Pradesh contribute 14% each to total production in the country.  Source: GoI, Department of Agriculture & Cooperation (2014-15)

Important Varieties Cultivated:

Type 27, Type 56, Pusa 1, Pant 430, Khargone 3, ADT 1 to 3, HPU 6, T 65, LBG 402, LBG 22, LBG 20

Major Markets

Spot markets:

Central India: Mumbai, Jalgaon, Latur, Akola, Indore, Bhopal, Vidisha

Northern India: Delhi, Kanpur, Hapur, Jalandhar, Ludhiana

Southern India: Hyderabad, Vijayawada, Gulbarga, Sirsa, Sangrur, Chennai

Futures markets:

Futures’ trading in urad was suspended in 2007.

External Trade

India is a net importer of urad. Imports are mainly sourced from Myanmar to meet the domestic demand. These imports have been hovering around 2 to 5 lakh tonnes during the past few years.

Major export destinations: NA

Major import sources: Myanmar

Factors Influencing Prices

o Changes in minimum support prices (MSP)

o Direct procurement by the government agencies and storage in warehouses

o Restriction on stock holding limits of the commodity

o Change in tariffs and

o Ban or changes in external trade policies with respect to the commodity.

|