Mumbai, June 11 (CommoditiesControl): Turmeric prices showed mixed trends across various markets, with lower prices reported in Duggirala, Hingoli, Basmatnagar, and Erode, while Kesamudram saw higher prices. Demand has remained subdued since the NCDEX prices dropped last week, leading buyers to remain cautious and purchase only as needed.

Arrivals have decreased significantly, from 20,860 bags in the previous session to 14,187 bags. Market participants attribute this to a projected 20-25% reduction in production this season compared to last year, indicating lower arrivals throughout the season. Despite this, uncertainty and rumors are keeping prices relatively stable.

Following a 1.5% drop in prices yesterday, there was a slight recovery as buying increased at lower levels. August futures prices rose by 0.6%, while October contracts increased by 1.9%. Over the past 10-12 sessions, prices have fallen by 17-18%, driven by speculation about a potential turnover cap on NCDEX trading.

NCDEX Spot Prices (Rs/Qtl):

- Nizamabad - NCDEX Polished: 18,111

- Nizamabad - NCDEX Unpolished: 17,155

- Sangli - NCDEX Rajapore: 19,297

NCDEX Future Prices (Rs/Qtl):

- Aug-24: 17,778 (+112, +0.6%)

- Oct-24: 18,640 (+350, +1.9%)

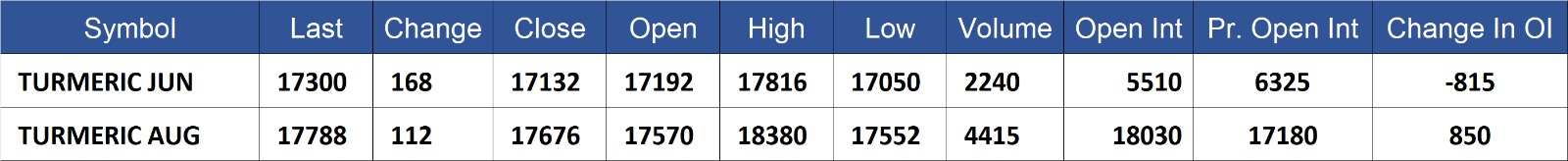

Turmeric contract for JUN delivery settled at Rs 17300/quintal showing an rise of Rs 168 over previous close of Rs 17132/quintal,The contract moved in the range of Rs 17050-17816 for the day. Open interest decreased by -815 MT to 5510 MT, while trading volume decreased by -1460 to 2240 MT.

Turmeric contract for AUG delivery settled at Rs 17788/quintal showing an rise of Rs 112 over previous close of Rs 17676/quintal,The contract moved in the range of Rs 17552-18380 for the day. Open interest increased by 850 MT to 18030 MT, while trading volume decreased by -490 to 4415 MT.

Currently The spread between JUN and AUG contract is -488 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)