Ahmedabad, June 11 (CommoditiesControl): The cumin market in Gujarat is experiencing a decline in prices due to a significant drop in demand. This trend is largely attributed to a slowdown in export activities, which has had a noticeable impact on local trade. As a result, cumin prices softened by Rs 50-75 per 20 kg today.

Brokers in Gondal highlight that the current high prices of cumin are deterring trade. Adding to this, the arrival of new cumin crops in China is reducing the demand for Indian cumin. This situation is causing uncertainty in the futures market, particularly as the June expiry approaches.

In Unjha, the arrival of cumin has decreased. Today, around 14,000 bags arrived, which is an increase compared to last week. However, due to low trading activity, most of these goods are being stored in warehouses. This influx into storage has prevented any significant rise in the average cumin prices, and any price increases seen are speculative at best.

Today, in Unja Mandi, the price of rough cumin ranged from Rs 4700-4900 per 20 kg, while the best quality cumin fetched Rs 5300-5400 per 20 kg. Bombay Bold variety was priced between Rs 5400-5800 per 20 kg.

In Gondal Mandi, the prices ranged from Rs 5231-5381 per 20 kg with an arrival of 331 bags. Meanwhile, Rajkot Mandi saw an arrival of around 1000 bags, with prices ranging from Rs 4250-5430 per 20 kg.

Overall, the current situation in the cumin market reflects broader trends and challenges, such as fluctuating demand and competition from international markets, which are influencing local pricing.

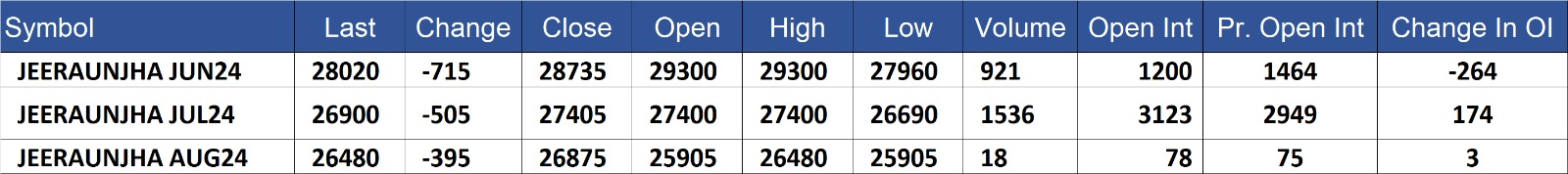

Jeeraunjha contract for JUN delivery settled at Rs 28020/quintal showing an fall of Rs -715 over previous close of Rs 28735/quintal,The contract moved in the range of Rs 27960-29300 for the day. Open interest decreased by -264 MT to 1200 MT, while trading volume decreased by -444 to 921 MT.

Jeeraunjha contract for JUL delivery settled at Rs 26900/quintal showing an fall of Rs -505 over previous close of Rs 27405/quintal,The contract moved in the range of Rs 26690-27400 for the day. Open interest increased by 174 MT to 3123 MT, while trading volume decreased by -174 to 1536 MT.

Jeeraunjha contract for AUG delivery settled at Rs 26480/quintal showing an fall of Rs -395 over previous close of Rs 26875/quintal,The contract moved in the range of Rs 25905-26480 for the day. Open interest increased by 3 MT to 78 MT, while trading volume decreased by -30 to 18 MT

Currently The spread between JUN and JUL contract is 1120 Rs/quintal.

Currently The spread between JUL and AUG contract is 420 Rs/quintal.

Currently The spread between JUN and AUG contract is 1540 Rs/quintal.

JeeraUnjha stock in NCDEX accredited warehouse as on 11-Jun-2024, was NA MT

(By Commoditiescontrol Bureau: +91 9820130172)