Mumbai, June 12 (CommoditiesControl): Turmeric prices were reported as stable to weak, with notable declines in Warangal and Kesamudram.

In contrast, markets in Sangli, Cuddapah, Duggirala, Hingoli, Nanded, and Erode exhibited stable sentiments. This comes amidst low demand following last week's drop in NCDEX prices, causing buyers and stockists to adopt a cautious approach, while end users continue to buy on an as-needed basis.

Arrivals fell to 11,342 bags from 14,187 in the previous session, with lower arrivals reported across the market. Market participants attribute this to a projected production decrease of 20-25% this season compared to last year, which is expected to result in reduced arrivals throughout the season. Despite this, uncertainty in policies and rumors have kept prices relatively stable.

Following a slight recovery yesterday, turmeric prices in NCDEX markets fell marginally today, reaching a two-month low. Prices dropped by 0.15% in August and 0.4% in October contracts. Over the last 10-12 sessions, prices have decreased by 17-18%, driven by speculation about a potential turnover cap on the NCDEX.

NCDEX Spot Prices (Rs/Qtl):

- Nizamabad - NCDEX Polished: 18,120

- Nizamabad - NCDEX Unpolished: 17,148

- Sangli - NCDEX Rajapore: 19,326

NCDEX Future Prices (Rs/Qtl):

- August 2024: 17,802 (-26, -0.15%)

- October 2024: 18,560 (-74, -0.4%)

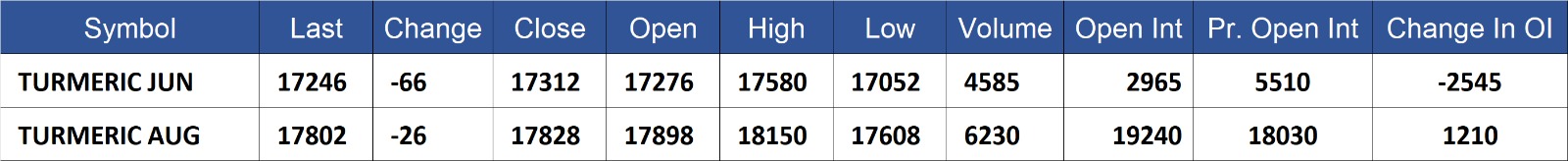

Turmeric contract for JUN delivery settled at Rs 17246/quintal showing an fall of Rs -66 over previous close of Rs 17312/quintal,The contract moved in the range of Rs 17052-17580 for the day. Open interest decreased by -2545 MT to 2965 MT, while trading volume increased by 2345 to 4585 MT.

Turmeric contract for AUG delivery settled at Rs 17802/quintal showing an fall of Rs -26 over previous close of Rs 17828/quintal,The contract moved in the range of Rs 17608-18150 for the day. Open interest increased by 1210 MT to 19240 MT, while trading volume increased by 1815 to 6230 MT.

Currently The spread between JUN and AUG contract is -556 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)