Mumbai, June 28 (CommoditiesControl): Turmeric prices showed a mixed trend in major markets today. Prices rose in Duggirala and Hingoli, but fell in Basmatnagar and Kesamudram, while other centers remained relatively stable. A significant drop in NCDEX futures during the final hours of trading could lead to lower spot market prices tomorrow. Sources indicate that buyers and stockists remain cautious, while end users are purchasing based on immediate needs, putting pressure on prices.

Arrivals increased slightly to 12,875 bags from 12,105 in the previous session, with all markets open today. The monsoon season has begun in South India and Maharashtra, regions where turmeric is widely grown. Farmers expect acreage to grow significantly this season.

April's EXIM data has also been released. Imports were six times higher than in the same month last year, totaling 3,588 metric tons (MT), while exports increased by 28%, reaching 14,110 MT. Exports to Bangladesh and Morocco decreased by 61% and 52%, respectively. Imports are primarily from Vietnam, Myanmar, and Cambodia.

After a brief recovery over two sessions, turmeric prices in NCDEX markets fell due to increased selling activity. Prices declined by 3.2% in August contracts and 3.3% in October contracts. Traders' confidence remains low, contributing to stable prices.

NCDEX Spot Prices (Rs/Qtl)

- Nizamabad - Polished: 17,742

- Nizamabad - Unpolished: 16,871

- Sangli - Rajapore: 18,850

NCDEX Future Prices (Rs/Qtl)

- August 2024: 16,850 (-554, -3.2%)

- October 2024: 17,762 (-608, -3.3%)

The mixed performance in spot prices and the significant drop in futures indicate a cautious market environment. The sharp increase in imports and stable trader confidence suggest that turmeric prices might face downward pressure in the coming days.

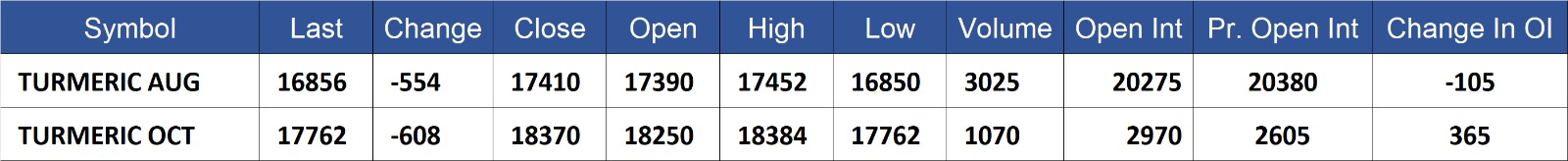

Turmeric contract for AUG delivery settled at Rs 16856/quintal showing an fall of Rs -554 over previous close of Rs 17410/quintal,The contract moved in the range of Rs 16850-17452 for the day. Open interest decreased by -105 MT to 20275 MT, while trading volume decreased by -1195 to 3025 MT.

Turmeric contract for OCT delivery settled at Rs 17762/quintal showing an fall of Rs -608 over previous close of Rs 18370/quintal,The contract moved in the range of Rs 17762-18384 for the day. Open interest increased by 365 MT to 2970 MT, while trading volume decreased by -1530 to 1070 MT.

Currently The spread between AUG and OCT contract is -906 Rs/quintal.

(By Commoditiescontrol Bureau: +91 9820130172)