Mumbai, 29 May 2024 (Commoditiescontrol): Tur prices in Myanmar continued their upward climb for the second day in a row, driven by robust demand from local stockists who are increasingly investing in pulses as a safeguard against expected currency depreciation.

Lemon tur prices saw a significant jump of 50,000 kyats, reaching 4,450,000 kyats on Wednesday. CIF prices also rose by $5 per metric ton (MT), settling at $1,455 per MT.

In related news, CNF India trade prices experienced a slight increase in the Burma market, while prices in the Chennai resale market remained stable.

However, domestic prices for both Burma Tur and African-origin Tur remained largely unchanged.

The upcoming monsoon season is expected to boost demand further, adding to the price support. Additionally, the demand for seeds is anticipated to keep prices stable for high-quality materials.

Experts predict that prices will continue to fluctuate within a wider range with a positive bias in the coming days. The combined effect of strong Indian demand, lower African production, and increased buying activity from millers is likely to maintain the upward pressure on tur prices.

Tur International Prices In Key Indian Markets:

Desi tur bilty prices across major markets in Maharashtra and Madhya Pradesh have climbed by Rs 100 per quintal, driven by strong demand from millers. While most leading mandis are experiencing this upward trend in bilty (all expenses paid) deals, the Latur market stands out as an exception. Prices in Latur have dropped by Rs 100, with trading now ranging between Rs 12,900 and Rs 13,000 per quintal.

Spot Raw Tur Bilty And Mandi Prices In Key Indian Markets:

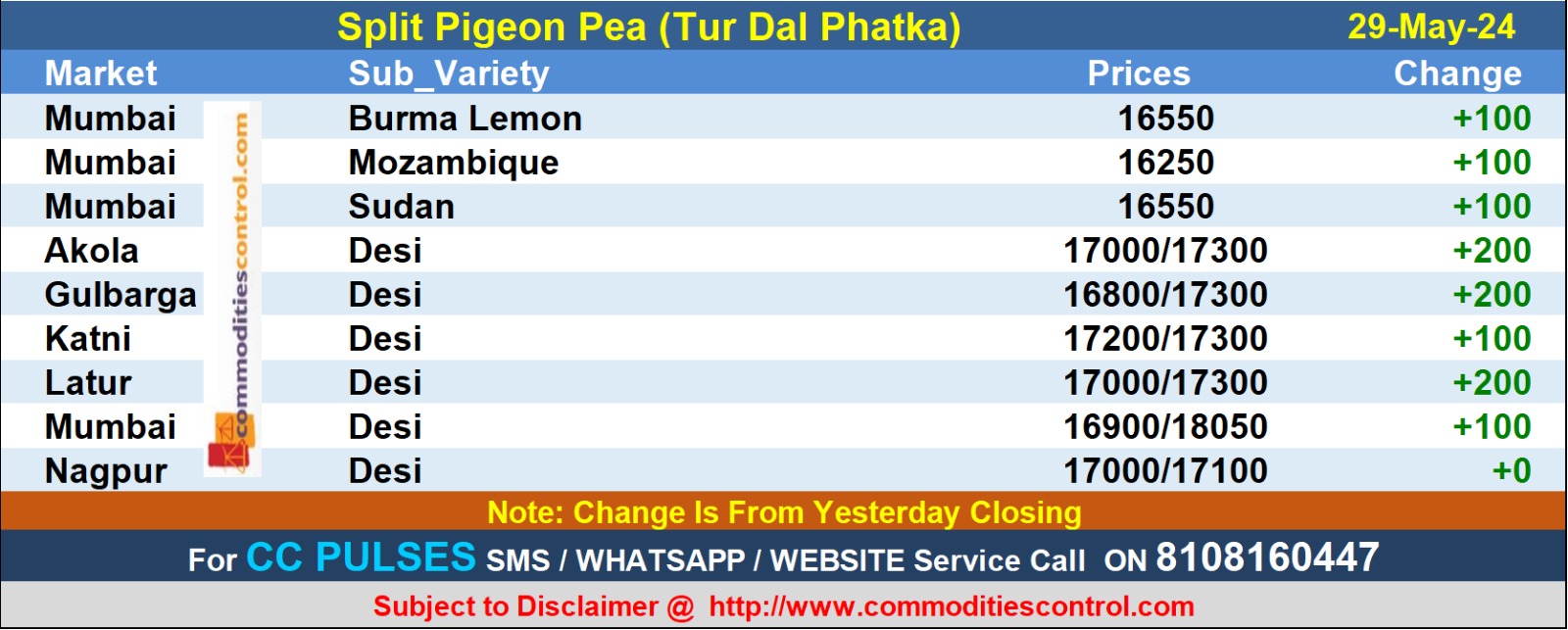

Rising raw tur prices have driven dal prices up by Rs 100-200 per quintal, following a Rs 400-600 per quintal increase over recent weeks. Millers' reluctance to sell is contributing to price stability. Split pigeon (tur) dal prices have also risen due to continued mill buying. Desi tur dal prices in key markets are up by Rs 100-200, while Burma Leman and Mozambique tur dal prices have increased by Rs 100.

Spot Raw Tur Dal Prices In Key Indian Markets:

Tur prices are projected to stay firm due to increased demand post-mango season, as stockists hold onto their inventory anticipating further price hikes driven by this season's production shortfall. However, the widening price gap between tur and its substitutes could lead to demand destruction, making it difficult for stockists to sell their holdings at elevated prices. Experts advise stockists to capitalize on price increases and liquidate their tur stocks strategically. Favorable monsoon conditions and expected higher sowing in the Kharif season could potentially reverse the current upward trend in tur prices.

(By Commoditiescontrol Bureau; +91-9820130172)